Lumber Market Changes: How These New Tariffs Will Shape the Industry

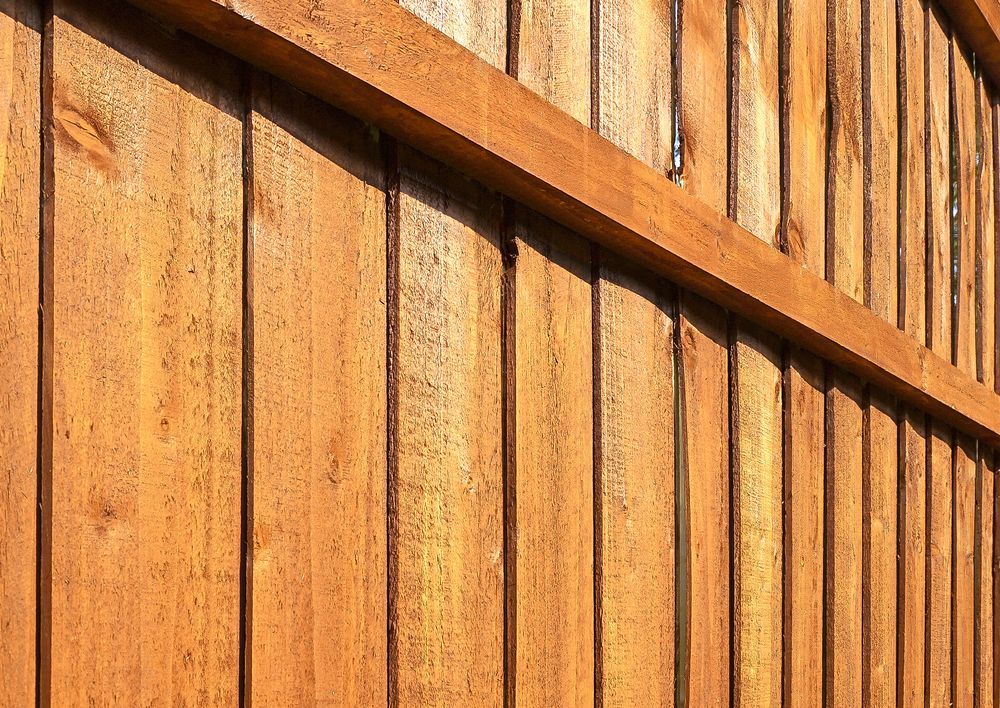

The economic situation in North America is currently marked by one of the most intense trade conflicts in recent history. President Trump's decision to impose new tariffs—10% on all imports from China and 25% on goods from Mexico and Canada—has reverberated across global markets, and several industries are poised to feel the strain.

One of the most significant sectors affected is Canadian lumber, which plays a crucial role in the US timber market.

New Tariffs Impacting Key Trading Partners

President Donald Trump declared an economic emergency to enforce new tariffs, specifically targeting Canadian imports with a 25% duty. Canada is a major trade partner for the US, and the tariffs focus on a range of goods, including energy products (oil, natural gas, and electricity) and timber.

On August 13, 2024, the U.S. Department of Commerce issued its final findings in the Fifth Annual Administrative Review of Canadian lumber exports. This review resulted in a new combined duty rate of 14.54%, nearly double the previous rate of 8.05%. The new rate applies to both past shipments from 2022 and future exports.

For the Canadian softwood lumber sector, already the largest foreign supplier of softwood lumber to the U.S., this poses a significant challenge. Industry experts believe that the 25% tariff imposed under the economic emergency could be added on top of the newly adjusted duty rate, bringing the total effective tariff to 39.5%. This situation is expected to affect lumber producers and professionals in the forest products industry on both sides of the border.

Though there was a one-month delay announced for these tariffs on February 4, understanding their potential effects remains crucial.

What Effects Will These Tariffs Have on the US Lumber Market?

Both Canada (on the supply side) and the U.S. (on the demand side) are set to face significant challenges. However, the U.S. market may emerge in a stronger position in the long term.

ResourceWise estimates that approximately 1.3 billion board feet of lumber capacity in British Columbia is now at risk due to these tariffs. The added expenses make it more difficult for Canadian producers to export lumber to the U.S. profitably.

Canada is a leading supplier of Spruce-Pine-Fir (SPF) lumber. When U.S. demand exceeded Canadian supply in the past, the Pacific Northwest (PNW) stepped in to fill the gap, followed by imports from Europe. Currently, European imports meet about 6% of U.S. demand. With tariffs on Canadian lumber increasing, PNW producers and European exporters are expected to benefit from this shift.

As PNW production rises to compensate for reduced Canadian imports, log availability in the region will decrease, leading to higher log prices and increased pressure on sawmill profits.

Southern Yellow Pine (SYP), though not a direct substitute for SPF in framing applications, might see an uptick in demand, benefiting the South. However, log prices are not expected to rise significantly due to an ample supply of pine sawtimber.

Potential Adaptations for the US Lumber Market

To make up for the reduction in Canadian supply, several potential scenarios could unfold:

- Increased Production in the Pacific Northwest (PNW): Operating rates in the PNW are currently low, but are expected to rise from the low 70% range to approximately 80%. This increase could boost lumber production by 5% to 10%, adding up to 1.3 billion board feet annually. However, this may come with higher log prices as demand for logs increases.

- Scaling Up Southern Production: Southern sawmills might also increase their production to fill the gap. If PNW production only rises by 5%, the shortfall will require a 3% boost in Southern production. With no shortage of sawlogs, sawtimber prices in the South are expected to remain stable.

- Boosting European Imports: If PNW production is on the lower end of the projected range, Europe could increase its exports to the U.S. by 22% to help fill the supply gap. However, to make these volumes profitable, lumber prices will need to increase sustainably.

What Should Forest Products Professionals Expect?

The full effects of the tariffs on the lumber market won’t be felt immediately, but their long-term impact could reshape industry dynamics. A decline in Canadian lumber imports might lead to mill closures and a permanent reduction in capacity. This shift could open opportunities for U.S. producers or European importers to fill the gap.

Global buyers will need to diversify their sourcing strategies more than ever. However, geopolitical and economic uncertainties mean that diversification carries its own risks.

Staying Prepared in an Evolving Economic Landscape

The U.S. lumber market is preparing for a challenging period, and it’s crucial for businesses to adapt. The ongoing U.S.-Canada trade tensions underscore the fragile nature of global trade, and for lumber producers, these tariffs present both a challenge and an opportunity.

Staying informed and leveraging data-driven strategies is key to maintaining competitiveness during this period of change.

ResourceWise offers tools to help forest products professionals navigate these shifts, providing:

- Market Data: Access to real-time information on lumber supply, pricing, and demand trends.

- Expert Insights: Analysis of how tariffs and geopolitical tensions affect the marketplace.

-

- Forecasting Tools: Advanced tools to predict market shifts and plan accordingly.